*Mr. Cuban may receive financial compensation for his support.

Last updated: April 22, 2024

Starting an LLC in Alabama involves some red tape, which isn’t likely the part of being a business owner you’re most looking forward to. You’re probably looking forward to the state’s low cost of living and doing business, the low property taxes, and the thrill of entrepreneurship.

We can make the LLC Alabama process smoother and let you focus on what’s important — growing your business. Let’s take a closer look at starting an LLC in Alabama and how we can help.

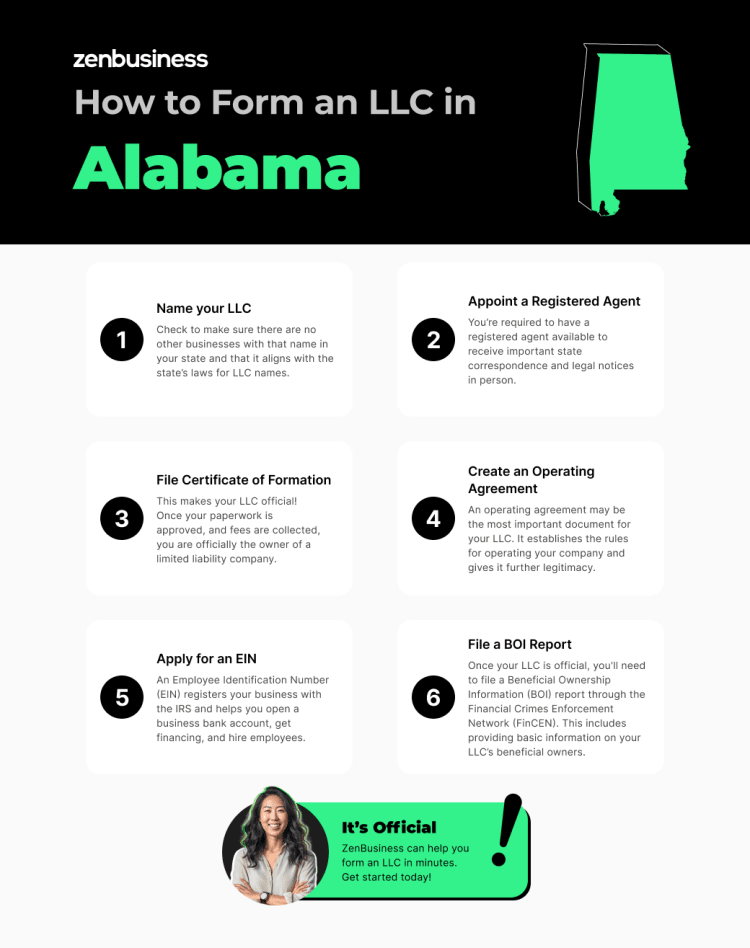

How to Start an LLC in Alabama

To show you how an Alabama limited liability company (LLC) is created, we’ve broken down the formation process into six steps. These steps will show you how to start an LLC in Alabama and are integral to registering your LLC Alabama with the Yellowhammer State. This means filing the right documents with the Alabama Secretary of State’s office, in addition to having the right tools to keep your business running smoothly.

- Name your Alabama LLC

- Appoint a registered agent in Alabama

- File an Alabama Certificate of Formation

- Create an Alabama operating agreement

- Apply for an EIN

- File your LLC’s BOI report

There’s no need to feel overwhelmed by these requirements. At ZenBusiness, we offer a variety of formation and compliance services. We help take some of the stress of forming an Alabama LLC off of your plate.

Step 1: Name your Alabama LLC

If you’ve already been brainstorming the perfect name for your LLC, there are a few things to keep in mind. An Alabama LLC needs to adhere to the following requirements:

- Your name must include the words “Limited Liability Company” or the abbreviations “LLC” or “L.L.C.”

- Your name must not be in use by another business in the state of Alabama.

- Some words require special permission to use (for example, “insurance” or “engineer” would require proof of specific licenses).

How can you tell if the name you’d like to use for your LLC is already taken? To find out, search for your preferred name using the Secretary of State’s Business Entity Search tool. If you’re unfamiliar with these systems, never fear. Take a look at our guide to Alabama business entity searches and we’ll walk you through the process.

Submit a Name Reservation Request Form for your LLC in Alabama

Unlike other states, Alabama requires you to submit a “Name Reservation Request Form for Domestic Entities” with your Certificate of Formation, the official paperwork that creates your LLC in AL.

If you’ve found the right name but aren’t quite ready to officially form your Alabama LLC, you can go ahead and submit that name reservation form prior to filing the Certificate of Formation. This will reserve the name with the state for up to a year.

Previously, Alabama forced new businesses to file this name reservation form with the state a few weeks before even forming their business. However, as of 2021, this form can be submitted along with your Certificate of Formation instead of submitting it ahead of time.

Reserving Your Alabama LLC Domain Name

When you’re pondering the right business name. It’s a good idea to consider whether you can secure a matching domain name.

We have a tool to help you do a preliminary domain name search, and our domain name registration service can help you secure the online name that will best serve your Alabama LLC.

Filing a DBA in Alabama

If the name you pick for your LLC doesn’t always convey the vision you have for your business, you can file an Alabama DBA, or “doing business as” name application with the state. This allows you to operate your business under a name other than the LLC’s official name, all while filing state formation and compliance documents under the official registered LLC name.

Ready to Start Your Alabama LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in Alabama

If you’re starting a business for the first time, you may not be familiar with the term “registered agent.” The state of Alabama requires appointing and maintaining a registered agent, who can be a person or business entity that accepts service of process on behalf of your Alabama limited liability company.

Because of the nature of their role, registered agents need a physical address in the state of Alabama (a P.O. box won’t work). This location is referred to as your “registered office.” Additionally, your Alabama registered agent must be available to receive official paperwork at that address during standard business hours (Monday to Friday, 9 a.m. to 5 p.m.).

Why is a registered agent so important?

The registered agent role is crucial because the agent is the one who will accept service of process (notice about a lawsuit) and some other state communications on your business’s behalf. By requiring every business to have a registered agent, the state guarantees that they have a reliable person to deliver mail to when they need to.

The registered agent requirement also helps protect business owners, helping ensure that owners always know if there’s a case against them. This gives them the opportunity to defend themselves in court and get the most favorable settlement they can (or potentially even settle out of court, depending on the circumstances).

Being your own registered agent

Many business owners assume they will serve as their own registered agent, using their business location as the registered address. Unfortunately, there are several reasons this choice might not prove advantageous in the long run:

- If you’re sued, you’ll be served paperwork at your place of business or your house. This could create embarrassment in front of your employees and customers.

- You’ll be required to stay at your registered office during standard business hours. This can be a tricky requirement if you plan to travel for work, let alone take a long vacation at any time in the future. Even the occasional sick day could cause a problem.

Consider a registered agent service for your Alabama LLC

Thankfully, there’s an easy and affordable solution: You can hire a commercial registered agent service to perform this role for your LLC. We offer registered agent services in Alabama, offering the consistency and accountability you need.

As your registered agent service, we’ll receive any documents on your behalf and scan them to our online portal, where you can review and respond to them instantly. Forget worrying about always being available: Let us take on that responsibility, allowing you to focus on growing your business.

Step 3: File an Alabama Certificate of Formation

When forming an LLC in Alabama, one document makes your business official, a Certificate of Formation. Of all the red tape you’ll have to overcome, this is the paperwork that matters most.

Your Certificate of Formation need to include the following:

- Name of your new LLC (be sure to attach the Name Reservation Certificate we discussed in Step 1).

- The name and address of your registered agent.

- Give the name of the person who prepared the form (either your name or someone else on your behalf).

In the past, starting an Alabama LLC required you to send a copy of your application to both the business entities division and your county probate judge. That requirement no longer exists.

File and Store your new Alabama LLC Documents digitally

Filing official government documents like this can be intimidating and/or confounding for many people, which is why we’re here. With our business formation plans, our professionals handle the filing for you to make sure it’s done quickly and correctly the first time.

Keep all your Alabama LLC formation documents in one place

If you do take advantage of our services, all of your LLC’s documents will be uploaded to your ZenBusiness dashboard, where you can keep it and other important paperwork digitally organized.

In addition, our customized business kits give you somewhere to make sure your physical paperwork like your operating agreement, member certificates, contracts, compliance checklists, transfer ledger, etc. are safely stored.

Step 4: Create an Alabama Operating Agreement

An operating agreement can be critical in helping LLCs succeed, both in the early stages of the business and throughout the company’s existence. In basic terms, this document lays out the rules by which the company will operate. Including LLC members, management procedures, and the roles and responsibilities of specific members.

Alabama does not ask new LLCs to submit their operating agreements to the state. But having a comprehensive operating agreement for your Alabama LLC can be extremely helpful, especially when changes and challenges arise.

This is true even if you’re the only member of the LLC, positioning your new business for sustained success. Here are just a few ways that an operating agreement can help you and your new business:

- Help substantiate your LLC as separate from your personal assets. This could come in handy if your business incurs debt or legal liabilities.

- Prevent and resolve conflict among LLC members by clearly specifying how decisions will be reached in the event of disagreement. In the absence of these clear rules, arguments can drag on destructively.

- Set clear protocols for adding or removing members. If someone wants to leave the business or a new partner wants in, you’ll have a fair process in place.

- Designate specific roles and ownership privileges and outline specific ownership stakes. Without one, all members are assumed to have equal ownership by default.

How to Write an Operating Agreement

When you’re drafting an operating agreement, you can start from scratch, hire an attorney, or simply use our customizable template to help you get started. If you don’t write one, your LLC will be governed by Alabama’s default rules. These default rules might not reflect the reality of your business.

While every company’s operating agreement (and how it’s written) will look different, here are some of the essentials you may want to include:

- Your management structure: member-managed vs. manager-managed

- How major decisions will be made (multi-member LLCs)

- Distribution of profits (how and when)

- Procedure to add or remove members

- How dissolution could occur

Of course, this isn’t an exhaustive list. Your operating agreement should fit the needs of your unique LLC.

Step 5: Apply for an EIN

While you’ve filled out plenty of paperwork for Alabama’s government, you’ll probably still need to register your business with the federal government. The Internal Revenue Service (IRS) has a numeric system for tracking business entities, creating ID numbers for companies to use for tax purposes.

This nine-digit number is called an Employer Identification Number (EIN), and you’ll more than likely need one, even if your LLC is single-member. But if you have other members (owners) in your LLC or hope to employ anyone, you’ll need to get an EIN as soon as possible.

Even if you don’t technically need an EIN to meet your tax obligations, it could be a good idea to get one for the following reasons:

- You may need one to do business banking: Most financial institutions will require an EIN if you intend to open a bank account connected with your LLC.

- You may need one to obtain financing: If you ever need a business loan or hope to take on outside investment, you’ll have to have an EIN to receive any capital.

- EINs can help prevent identity theft: If you don’t have an EIN for your business, you’ll need to provide your own Social Security number instead. Putting your Social Security number on a ton of forms could prove problematic.

You can get your Alabama LLC’s EIN through the Internal Revenue Service website, by mail, or by fax, but if you’re unfond of dealing with that particular government agency, we can get it for you. Our EIN service is quick and eliminates the hassle.

Step 6: File a beneficial ownership information report for your LLC

Once Alabama has approved your Certificate of Formation and your LLC is official, you’ll need to file a beneficial ownership information report, or BOI report. This form is submitted to the Financial Crimes Enforcement Network (FinCEN) in compliance with the Corporate Transparency Act. It’s a new requirement in 2024.

The act strives to deter corporate financial crimes by making it more difficult for organizations to hide illicit activities behind shell corporations. That’s why the BOI report asks you for the name, address, and identifying documents of each beneficial owner for your LLC. According to the act, a beneficial owner is anyone who exercises significant control over the business, gets substantial economic benefit from the LLC’s assets, or holds 25% or more of the ownership interest. Failing to disclose this information can have severe civil and criminal penalties.

FinCEN accepts BOI reports through online filing or PDF uploads. If you’re starting your LLC in 2024, you’ll have 90 days after formation to submit your BOI report, and LLCs created in 2025 and beyond will have just 30 days. Any LLCs that organized prior to 2024 have until January 1, 2025, to file.

For more information on the BOI report, check out FinCEN’s website. Our BOI report filing service can make this step a snap, too.

Next Steps After Forming Your LLC in Alabama

After forming your LLC in Alabama, your work isn’t quite finished. There are a few additional steps to complete to help ensure your business is fully operational and compliant. These steps are crucial to help set up your business for success today and into the future.

Obtaining Licenses and Permits

After establishing your LLC, it’s your responsibility to get any licenses or permits that your business is subject to. For starters, you’ll need to get a privilege license from your county probate judge (in every county where you operate).

But this general license isn’t the only one you might need. There’s a good chance you’ll need an industry-specific permit from a federal or state agency, too. There are also local licenses and permits to consider, such as zoning. If researching these licenses seems like a hassle, our business license report can help.

Opening a Business Bank Account

Every LLC needs its own bank account to help keep business assets separate from personal assets. Applying for an account is usually relatively straightforward. But be prepared to provide specific documentation requested by your bank, such as your EIN, your Certificate of Formation, your operating agreement, or even a copy of your business plan.

The good news is that we offer a discounted bank account for new businesses. It allows unlimited transactions, online banking, a debit card, and more. When you want to authorize others in your business to use the account, we offer a banking resolution template to simplify the process.

For further help managing your new business’s finances, try ZenBusiness Money. It can help you create invoices, receive payments, transfer money, and manage clients all in one place.

Setting Up an Accounting System

Implementing a robust accounting system is key to managing your finances effectively, preparing for tax season, and making informed business decisions. There are a variety of tools available to you, from a simple spreadsheet to bookkeeping software or our streamlined Money app.

Ultimately, the system you use is up to personal preference, but having one is essential to managing your business finances.

Filing Your Annual Report

It’s not uncommon for states to require LLCs to file an annual report, and Alabama is no exception. But in Alabama, the “annual report” is actually the annual Business Privilege Tax (BPT) return. To stay in good standing, you’ll need to file this tax return every year. The BPT due date matches your federal returns, so you can handle it at tax time. The rate ranges between $0.25 to $1.75 per $1,000 of net worth for your business, with a minimum tax of $50.

Staying Informed About Ongoing Legal and Tax Requirements

Regularly updating yourself on legal and tax obligations is vital to ensure your LLC remains compliant with state and federal laws. State laws and tax policies can change over time, and it’s your responsibility to stay informed and adapt.

For this reason, many small business owners choose to consult with a state business attorney or CPA regularly to get customized, updated guidance for their LLC’s unique circumstances.

Pros and Cons of an Alabama LLC

An Alabama LLC is a popular business entity choice for a lot of small business owners because the structure presents a lot of advantages. But there are disadvantages, too. Let’s chat through the pros and cons of an LLC in Alabama.

Advantages

An Alabama LLC presents a lot of advantages.

Limited Liability Protection

An LLC is a separate legal entity that’s distinct from its owners. Thanks to that separation, your personal assets (like your home, car, and savings) are usually shielded from business debts and liabilities. In case of business troubles, your personal property usually remains protected.

Tax Flexibility

LLCs in Alabama can choose how they are taxed, potentially lowering tax burdens. By default, they’re subject to pass-through taxation, avoiding the double taxation faced by corporations. They can also elect C corporation or S corporation tax status, which (in certain cases) can also lead to tax savings. With an LLC, you have a choice.

Beyond that, Alabama also has a pretty favorable tax climate. The business privilege taxes are pretty manageable, and the personal tax rates and corporate income tax rates aren’t bad, either. Even property taxes are some of the lowest in the country.

Operational Flexibility

LLCs have fewer formalities and compliance requirements compared to corporations, making them easier to manage and operate. For example, an LLC isn’t required to draft and adhere to bylaws, hold shareholder meetings and a meeting for the board of directors, or publishing annual reports for your shareholders.

There is a requirement to file an annual BPT (your annual report), maintain your licenses, and pay other taxes. But compared to the annual requirements for corporations, these are quite simple.

Disadvantages

An LLC isn’t without its drawbacks, however.

Compliance Costs and Complexities

Maintaining an LLC in Alabama is easier than maintaining a corporation, but it’s more complicated than a sole proprietorship or general partnership. Initial registration can be expensive for entrepreneurs on a budget. There are also annual requirements like the business privilege tax.

Challenges for Raising Capital

LLCs might find it harder to raise capital as they cannot issue stock like corporations. Investors and venture capitalists also tend to be more hesitant to invest in LLCs. There are still options like grants and loans, but for some entrepreneurs, these capital challenges can be a significant drawback.

Risk of Piercing the Corporate Veil

The personal asset protection of an LLC is a significant advantage, but it isn’t all-powerful. If an LLC fails to maintain proper formalities, its liability protection can be compromised, exposing the owners’ personal assets to risk.

Cost to Start an LLC in Alabama

Starting an LLC — or any business, for that matter — in Alabama incurs certain expenses. Every business will have different costs and filing fees, but here are the most common ones you can expect:

- Certificate of Formation: $200

- BPT: minimum of $50, typically maxes at $15,000 for most business entities

- Business Name Reservation: $25

- Business licenses and permits: varies depending on industry

To start your business off on the right foot, you’ll need to budget for these expenses accordingly.

Need help with your Alabama LLC filing?

We offer fast, accurate Alabama LLC formation online. Our services provide long-term business support to help you start, run, and grow your business.

If starting an LLC in Alabama feels like an uphill battle, we can reduce your stress. Let us take care of formation, compliance, and more. That way, you can get back to running your dream business.

Related Topics

AL LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Alabama LLC FAQs

-

The state fees for forming an Alabama LLC can range from around $200 to $225, depending on a variety of factors. Note that fees change over time, so check the Alabama Secretary of State website for the most recent fee schedule.

-

If you’re reading this guide, you may already be familiar with the benefits of the LLC business structure. But if you’re still learning about the various kinds of business entities, you might want to know more about LLCs’ advantages, both in Alabama and nationwide.

There’s a reason that roughly 90% of our customers decide to form LLCs: they offer an attractive mix of simplicity and protection. Whereas corporations are subject to many regulations, LLCs provide a more streamlined approach to being in business. At the same time, LLCs provide important legal separations between businesses and their owners.

Here are some key benefits that LLCs offer:

- Personal asset protection

- Avoiding double taxation

- Fewer management obligations

- Minimal paperwork compared to corporations

As you can see, an LLC is a great business structure for many kinds of ventures.

-

You have some decisions to make about how the federal government will tax your LLC. If you’re the only member of the LLC, its default tax status with the IRS will be a “disregarded entity,” meaning you’ll pay personal income tax on the money you earn. If you have partners, your LLC will be regarded as a “partnership” by default: each member will pay income tax on their share of the profits. In both cases, the business itself doesn’t pay federal income tax.

However, you could also elect to file your company’s taxes as a corporation. Some owners of larger LLCs choose an S corp or C corp tax classification for their companies, for example, because doing so could allow them to save money on self-employment taxes or provide a wider range of deductions. A tax professional can help you determine what’s best for your LLC.

Your LLC will also likely need to address employment taxes, self-employment taxes, and more. Then, on the state level, you’ll need to pay the Alabama business privilege tax, sales tax, local business taxes, and more. Taxes can be pretty complicated, so we highly recommend consulting with a state tax attorney.

-

The state completely revamped it’s business entity submission and approval process a few years ago with the goal of reducing its seven-month processing timeline. Now, you can expect your filings to be approved or rejected in a few business days. The state also allows expedited filing if you’re in a time crunch.

-

Alabama does not require LLCs to file their operating agreements with the state.

-

In Alabama, all business entities (including LLCs) are subject to the business privilege tax mentioned above. The rate you pay is determined by your business’s net worth as computed using the state’s formula, with a minimum payment of $100 and a maximum of $15,000 (except for certain financial institutions). The tax structure you choose won’t affect how much this tax will cost you.

Additionally, because Alabama recognizes the federal S corporation designation, your LLC will not have to pay state corporate taxes if you’re designated as an LLC or S corporation with the IRS. Instead, only individual members will pay income tax on the money earned from the business. If you decide to have your LLC taxed as a C corporation, your LLC would have to pay Alabama’s corporate tax, however.

Accordingly, the question of whether to file as an LLC or S corporation or C corporation really depends on which will reduce your federal tax burden. While the default designation with the IRS would be a disregarded entity or partnership (depending on whether you have more than one member), filing as an S corporation or C corporation could have tax benefits.

-

The process of transferring ownership of your LLC should be clearly specified in the operating agreement you develop for your business. Protocols for adding and removing members and selling or transferring ownership can be articulated in this document, preventing conflict and unforeseen consequences.

-

Before starting the dissolution process, the members of an LLC should consult the dissolution process laid out in the operating agreement. For the subsequent steps, please refer to our Alabama business dissolution guide.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Alabama

Ready to Start Your LLC?